Major technology stocks, which have driven much of the stock market’s remarkable gains over the past year, have experienced a significant downturn this week. This marks the steepest decline for these stocks in nearly a year, triggered by new economic data and evolving expectations about Federal Reserve policies.

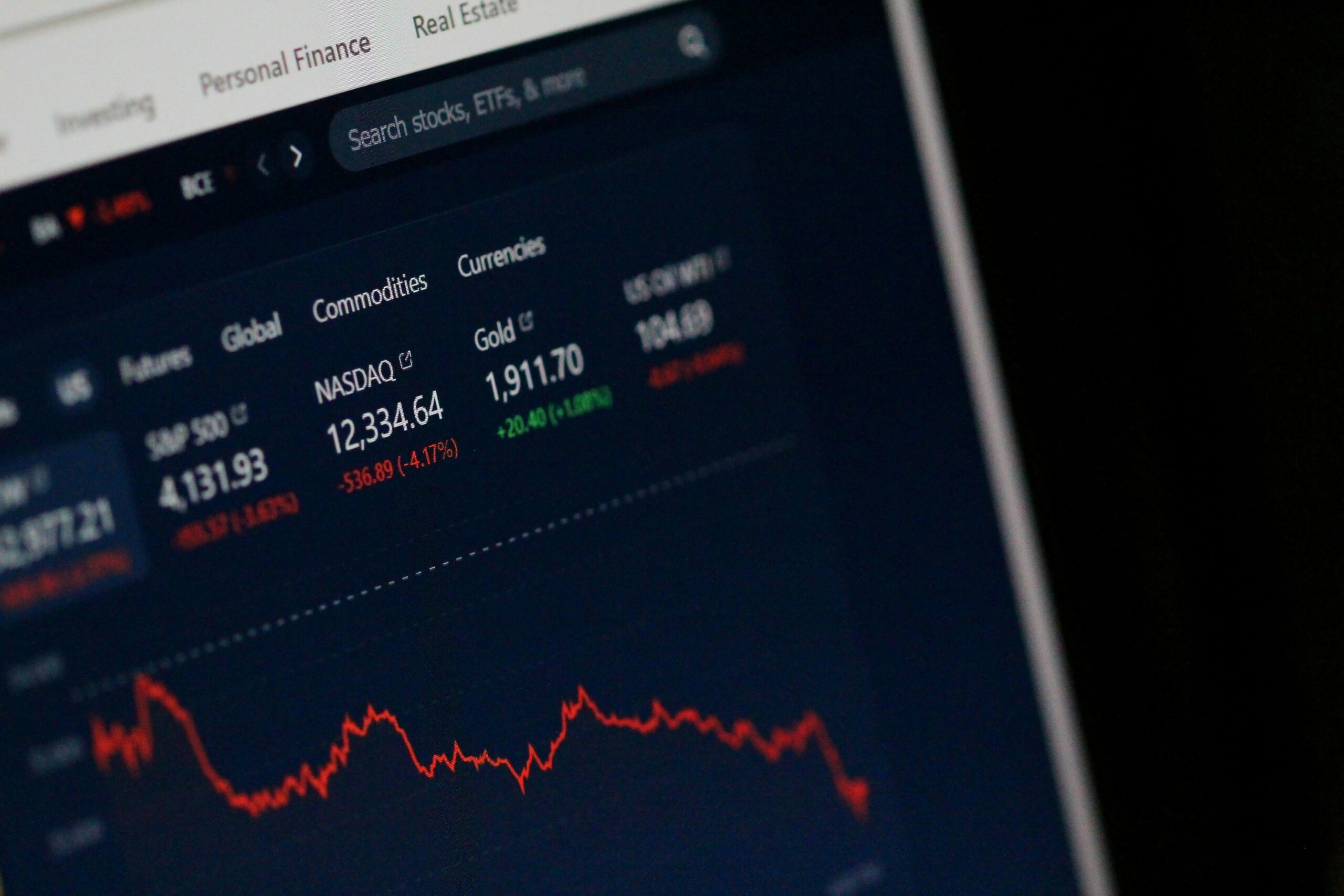

The S&P 500, which had enjoyed its longest winning streak since November, saw a 1% decline on Thursday. The drop was led by the so-called “Magnificent 7” — Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla — whose stocks have been pivotal in the index’s performance. Collectively, these tech giants saw their stocks tumble by as much as 4.1%, the most significant drop since July 2023.

The catalyst for this selloff was the latest inflation report, indicating that consumer prices cooled more than expected in June. This spurred speculation that the Federal Reserve might cut interest rates as soon as September. While a rate cut generally boosts the stock market, it led to a rotation out of high-flying tech stocks into other sectors more sensitive to interest rates, such as utilities and homebuilders.

“Investors are using this moment to reassess their allocations,” said Alexander Morris, CEO of F/m Investments. “The market was looking for something different, a new trade beyond just the big tech names.” This sentiment reflects a broader shift in investor strategy, as they seek opportunities in sectors that might benefit more immediately from lower interest rates.

Adding to the volatility, former President Donald Trump’s recent comments on Taiwan have significantly impacted semiconductor stocks. Trump suggested that Taiwan should pay the U.S. for defense costs, causing a notable drop in the stock price of Taiwan Semiconductor Manufacturing Company (TSMC). His remarks have raised concerns about U.S.-Taiwan relations and the broader geopolitical risks impacting the semiconductor industry, which relies heavily on Taiwan.

The Nasdaq Composite and S&P 500’s tech-heavy constituents bore the brunt of the selloff. Semiconductor stocks were particularly hard hit, with Nvidia shares dropping 5.6% and other semiconductor companies like Lam Research and Applied Materials falling by 6% and 5.4%, respectively. This decline extended to the broader technology sector, including companies heavily invested in AI and other advanced technologies.

Among the notable losers was Tesla, whose shares plunged 8.4% following news that the company would delay the unveiling of its highly anticipated robotaxi service. Originally set for August, the event has been pushed back to October to allow for further development. This postponement disrupted Tesla’s recent winning streak and contributed to the broader tech selloff.

In contrast, sectors more sensitive to interest rates, such as homebuilders and utilities, experienced gains. Shares of companies like D.R. Horton, Lennar, and PulteGroup surged as investors anticipated that lower borrowing costs would boost the housing market. Similarly, utility stocks enjoyed their best day since April, reflecting heightened expectations for a favorable rate environment.

This latest market shift underscores the volatile nature of the current economic landscape. The Federal Reserve’s next moves are being closely watched, with many market participants hoping for a more accommodative monetary policy in the face of cooling inflation. As such, the coming months will be crucial in determining whether this recent tech slump is a temporary correction or the beginning of a more sustained trend away from these market leaders.