The Federal Reserve raised interest rates on Wednesday for the ninth time in a row, signaling that it was more concerned about inflation than the turmoil in the banking sector that has rattled global markets.

The Fed lifted its benchmark rate by a quarter percentage point to a range of 1.75 to 2 percent, as widely expected by economists and investors. The central bank also projected one more rate increase this year, down from two previously, reflecting a more cautious outlook for the economy amid the uncertainty caused by the banking crisis.

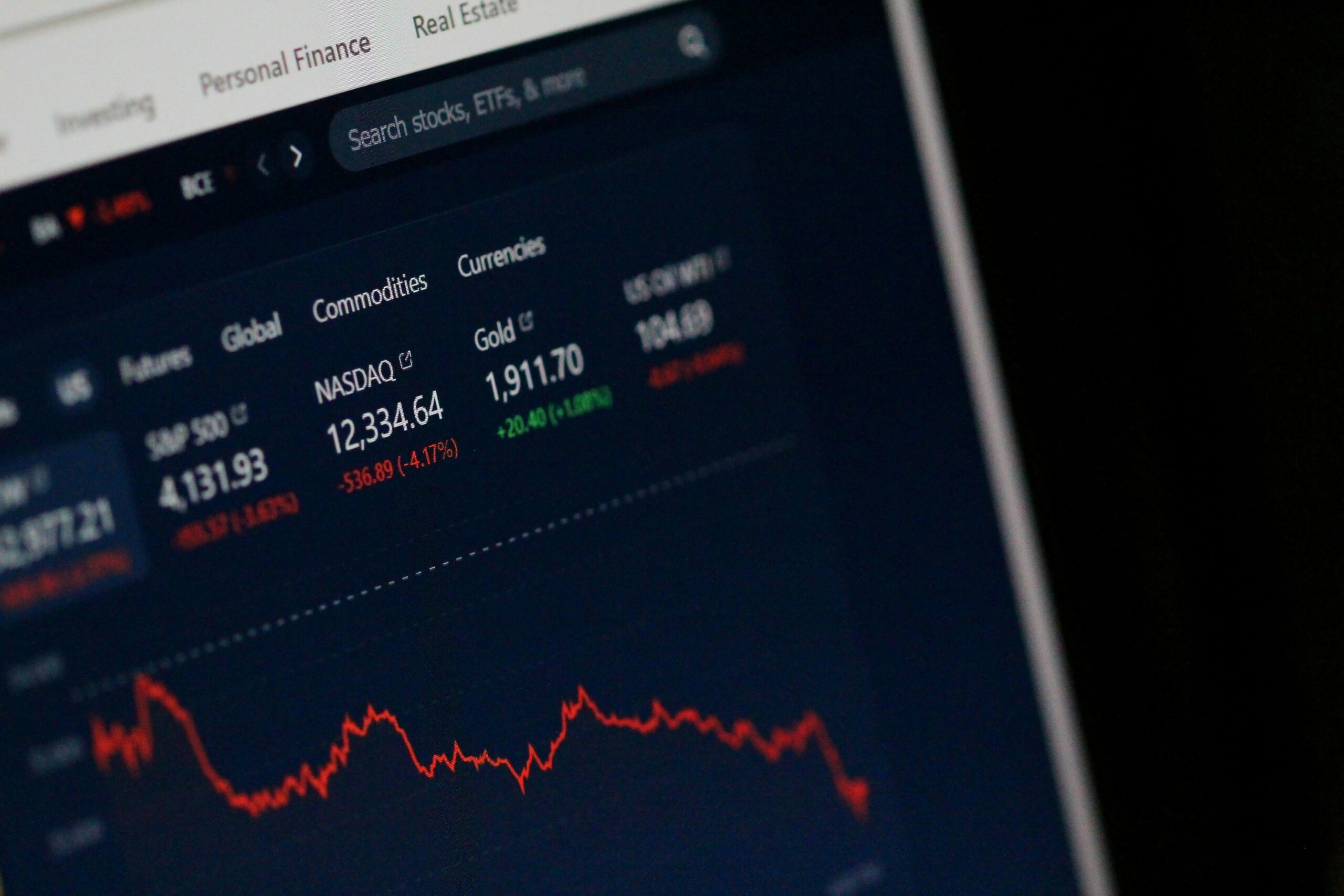

The Fed’s decision came as investors were digesting the latest developments in the worst shock to the financial system since the 2008 global financial crisis. In recent weeks, several banks have collapsed or faced severe losses due to their exposure to risky commercial real estate loans, which have soured as consumer behavior has changed and demand for office space has plummeted.

The most prominent casualty was Credit Suisse, the Swiss banking giant, which was forced to write down $17 billion of bonds backed by commercial mortgages and seek a bailout from the Swiss government. The bank’s troubles have sparked fears of contagion across the sector, especially among European lenders.

On Friday, shares of Deutsche Bank, Germany’s largest bank, plunged as investors fretted that regulators and central banks have yet to contain the crisis. The cost of insuring against the bank’s default spiked to record levels, indicating a loss of confidence in its ability to repay its debts.

The Fed’s chair, Jerome H. Powell, acknowledged that the banking crisis posed a significant risk to the stability of the financial system and the economy. He said that the Fed was closely monitoring the situation and was ready to use its emergency lending powers if needed.

However, he also said that the Fed’s rate-setting committee believed that the banking system was “sound and resilient” and that most banks had sufficient capital and liquidity buffers to withstand potential losses. He added that the Fed’s rate hikes were aimed at keeping inflation under control and preventing the economy from overheating.

“The economy is very strong,” Mr. Powell said at a news conference after the Fed’s meeting. “We’re in a very good place right now.”

The Fed’s latest economic projections showed that it expected inflation to run slightly above its 2 percent target this year and next, before moderating in 2024. The central bank also revised up its forecast for economic growth this year to 4 percent, from 3.8 percent in December, reflecting the impact of the $1.9 trillion stimulus package enacted by President Biden last month.

The stimulus package has boosted consumer spending and confidence, as well as hiring and wages. The unemployment rate fell to 3.9 percent in February, down from a peak of 14.8 percent in April last year, when the pandemic forced widespread lockdowns.

However, some economists and lawmakers have warned that the stimulus package could overheat the economy and fuel inflation, especially if supply bottlenecks persist. The Fed has maintained that the current bout of inflation is largely transitory and will fade as supply bottlenecks ease and demand normalizes.