UBS Group AG, Switzerland’s largest bank, said on Friday it had agreed to buy rival Credit Suisse Group AG for about $80 billion in a deal that would create a European banking powerhouse and end months of uncertainty over the fate of Credit Suisse.

The deal, which was announced after weeks of negotiations and regulatory approvals, would combine two of the world’s leading wealth managers and investment banks, with combined assets of more than $3 trillion and a presence in over 50 countries.

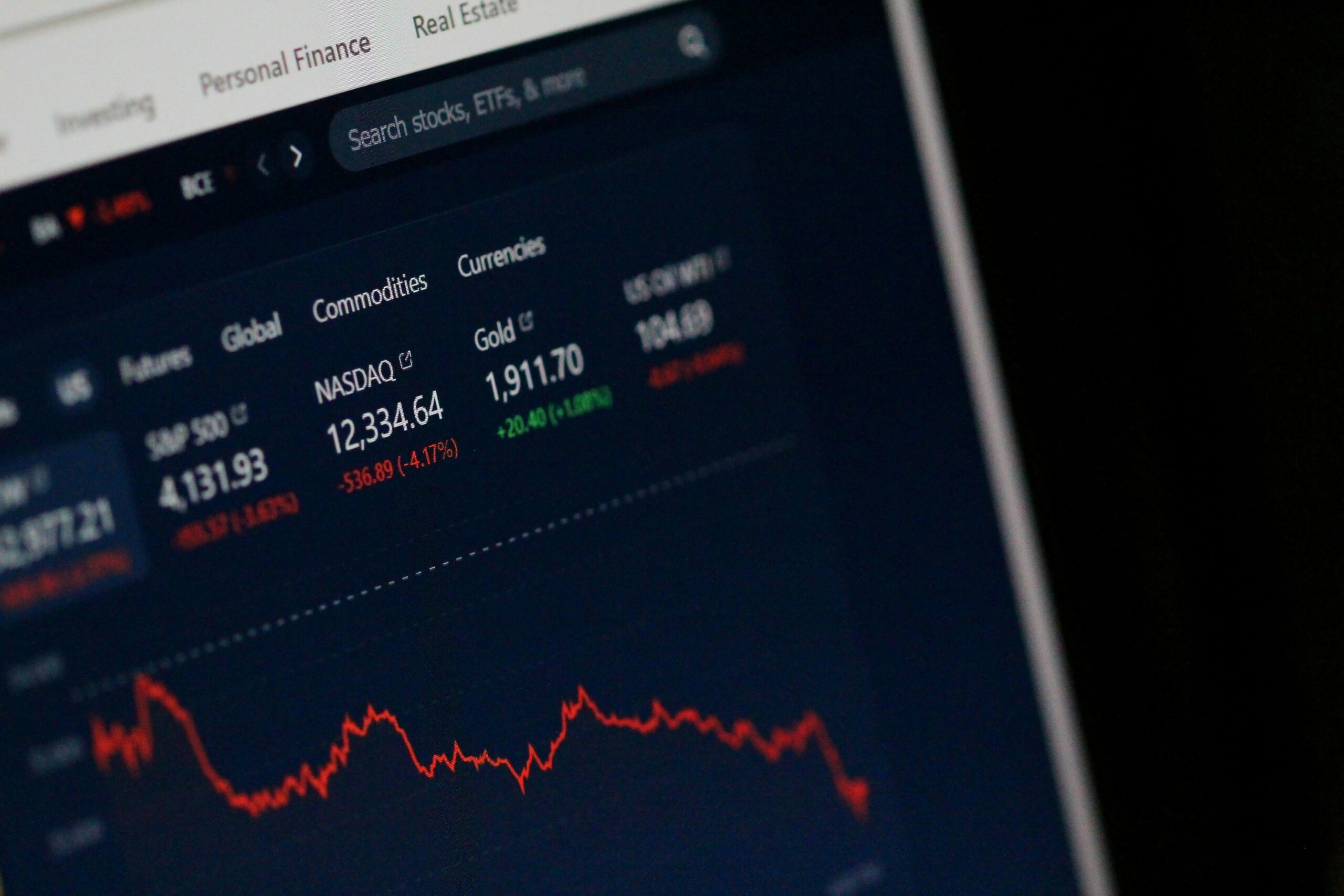

The merger comes as both banks have faced challenges from the fallout of the global banking crisis that erupted in 2023, triggered by a wave of defaults and bankruptcies in the commercial real estate sector and exacerbated by the Covid-19 pandemic.

Credit Suisse, which had been struggling with legal woes, regulatory fines and a series of scandals, was hit hard by the crisis and saw its share price plunge by more than 70% in the past year. The bank also faced pressure from activist investors and regulators to overhaul its governance and risk management.

UBS, which had fared better than Credit Suisse but still faced headwinds from low interest rates and increased competition, saw an opportunity to strengthen its position in the industry and diversify its revenue streams by acquiring its rival at a discount.

The deal values Credit Suisse at 10.5 Swiss francs per share, a 25% premium to its closing price on Thursday. UBS will pay 60% of the deal in cash and 40% in stock, giving Credit Suisse shareholders about 28% of the combined entity.

The new bank, which will keep the UBS name and be headquartered in Zurich, will be led by UBS Chief Executive Ralph Hamers, who took over the helm of UBS in November 2020. Thomas Gottstein, who became CEO of Credit Suisse in February 2020, will become president of the combined bank and oversee its Swiss operations.

The banks said they expected to achieve annual cost synergies of about $5 billion and revenue synergies of about $2 billion by 2026. They also said they would maintain their commitment to sustainable finance and social responsibility.

The deal was welcomed by investors, analysts and regulators, who saw it as a positive step for the stability and competitiveness of the European banking sector, which has lagged behind its U.S. and Asian peers in terms of profitability and innovation.

“This is a historic moment for Swiss banking and for European banking as a whole,” Hamers said in a statement. “By joining forces with Credit Suisse, we are creating a global leader that will offer unparalleled service and value to our clients, shareholders and employees.”

Gottstein said the deal was “a win-win situation” for both banks and their stakeholders. “We are proud to become part of UBS and to contribute to its success story,” he said. “Together, we will create a stronger, more resilient and more diversified bank that will be well-positioned for the future.”

The deal is expected to close in the second half of 2024, subject to approval by shareholders of both banks and regulators in Switzerland, Europe, the U.S. and other jurisdictions.

Analysis: Merger Raises Questions About Future of Banking

The UBS-Credit Suisse merger, which was announced on Friday as a rescue deal for the troubled Credit Suisse, has sent shockwaves across the global financial industry and raised questions about the future of banking in Europe and beyond.

The deal, which was orchestrated by the Swiss government and central bank, was seen as a last-ditch effort to prevent a collapse of Credit Suisse, which had been battered by a series of scandals and losses linked to the global banking crisis that erupted in 2023.

The crisis, which was triggered by a wave of defaults and bankruptcies in the commercial real estate sector and exacerbated by the Covid-19 pandemic, exposed the vulnerabilities and risks of the highly leveraged and interconnected banking system, especially in Europe, where many banks have struggled to cope with low interest rates, sluggish growth and stiff competition.

The UBS-Credit Suisse merger, which creates a banking behemoth with more than $5 trillion in total invested assets and a dominant position in wealth management and investment banking, was hailed by some as a positive step for the stability and competitiveness of the European banking sector, which has lagged behind its U.S. and Asian peers in terms of profitability and innovation.

However, the deal also raised concerns about the implications for financial regulation, competition, innovation and customer choice, as well as the potential social and economic costs of creating a bank that is too big to fail.

Some analysts and experts have questioned whether the merger will actually solve the underlying problems that plagued Credit Suisse and other banks, such as poor governance, risk management and culture, or whether it will simply create new challenges and risks for UBS and the wider financial system.

They have also warned that the merger could have negative consequences for smaller banks, customers and employees, as well as for Switzerland’s reputation and creditworthiness.

According to Moody’s, a credit rating agency, the merger could put pressure on Switzerland’s sovereign rating, which is currently at AAA, because of the increased exposure of the Swiss government to the banking sector and the potential need for further bailouts or guarantees in case of future shocks.

The merger could also lead to a loss of jobs, services and innovation in the banking industry, as UBS plans to slash up to 36,000 jobs after the deal, mainly in Switzerland and the U.S., where both banks have significant operations. The deal could also reduce competition and customer choice in some markets, especially in Switzerland, where UBS-Credit Suisse will have a dominant market share.

Moreover, some critics have argued that the merger goes against the spirit of financial regulation that was introduced after the 2008 global financial crisis to prevent banks from becoming too big to fail and posing systemic risks to the economy. They have called for stricter oversight and regulation of UBS-Credit Suisse and other large banks to ensure that they do not abuse their market power or engage in risky or unethical practices.

The UBS-Credit Suisse merger is expected to close in the second half of 2024, subject to approval by shareholders of both banks and regulators in Switzerland, Europe, the U.S. and other jurisdictions. However, it is likely to face legal challenges from some investors who are unhappy with the terms of the deal or who claim that their rights were violated by the Swiss authorities.

The merger is also likely to have ripple effects on other banks and markets around the world, as it could trigger further consolidation or restructuring in the banking industry or prompt other governments or regulators to intervene or revise their policies in response to the changing landscape.