China’s property sector, which accounts for a third of its economic output, is facing a severe downturn that could have global repercussions. The collapse of Evergrande, the country’s second-largest developer, has triggered a wave of defaults and protests by angry homebuyers, exposing the fragility of the highly leveraged industry.

Evergrande, which owes more than $300 billion to creditors, suppliers and investors, has been struggling to meet its obligations since last year, when Beijing tightened regulations on the sector to curb excessive borrowing and speculation. The company has stopped work on hundreds of projects across the country, leaving millions of customers in limbo and sparking social unrest.

The crisis has also spread to other developers, such as Fantasia Holdings and Sinic Holdings, which have also missed debt payments and seen their shares plunge. The turmoil has rattled the confidence of investors and consumers, who have been pulling out of the market amid fears of a further slump.

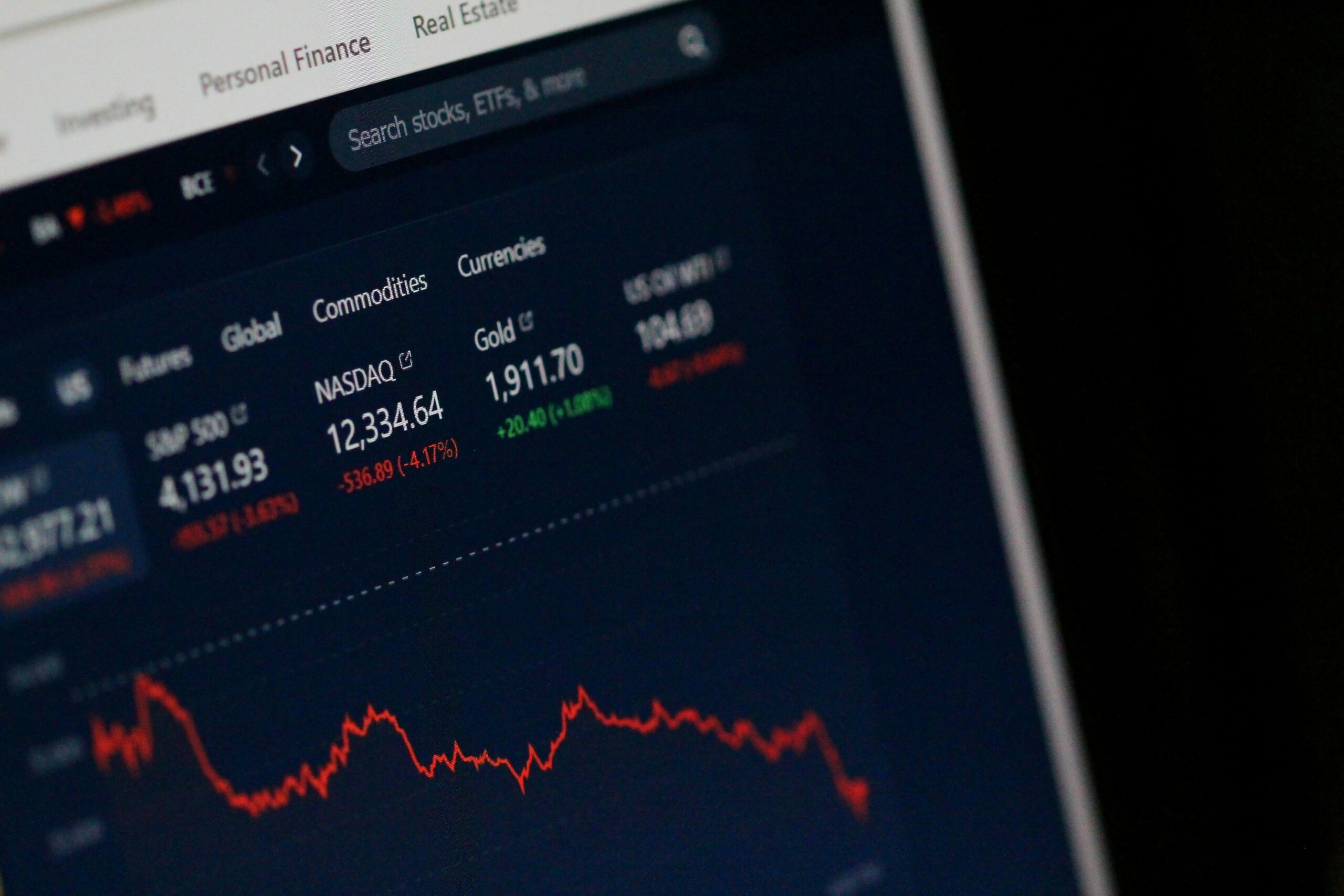

According to official data, property sales fell by 19.7% year-on-year in August, while investment growth slowed to 10.9%, the lowest level since April 2020. The decline in demand and prices has also weighed on related industries, such as construction, steel, cement and furniture, dragging down the overall economic growth.

Some analysts have warned that China’s property crisis could pose a systemic risk to the world’s second largest economy, which is already facing headwinds from the Covid-19 pandemic, trade tensions and environmental challenges. They have compared the situation to the US subprime mortgage crisis in 2007, which triggered a global financial meltdown.

However, others have argued that China’s property sector is unlikely to cause a similar catastrophe, given the differences in the structure and regulation of the markets. They have pointed out that China’s property loans are mostly backed by real assets and deposits, rather than complex financial instruments. They have also noted that China’s central government has ample fiscal and monetary tools to intervene and prevent a disorderly collapse.

Nevertheless, the Chinese authorities are facing a delicate balancing act between stabilizing the market and maintaining their long-term goal of curbing speculation and debt. They have adopted a cautious approach so far, avoiding direct bailouts or stimulus measures that could fuel moral hazard or inflation. Instead, they have urged local governments and state-owned enterprises to step in and help resolve the problems of troubled developers.

They have also tried to reassure the public that their housing needs will be met and that their rights will be protected. They have announced plans to accelerate the construction of affordable housing and rental units, as well as to improve the legal framework for property contracts and disputes.

The outcome of China’s property crisis will have significant implications for its economic and social stability, as well as for its global influence. The sector is not only a key driver of growth and employment, but also a source of wealth and welfare for hundreds of millions of people. It is also a major destination for foreign capital and a factor in China’s relations with other countries.

As such, the resolution of the crisis will require not only financial and technical solutions, but also political and strategic ones. It will test the wisdom and resolve of China’s leaders, as well as the resilience and adaptability of its people.