The Federal Reserve is unlikely to raise interest rates at its next meeting in November, according to a report by Goldman Sachs strategists published on Saturday. The report cited several factors that could persuade the central bank to hold off on further tightening of monetary policy this year, including lower inflation, slower economic growth and uncertainty over the debt ceiling and fiscal policy.

The report also predicted that the Fed would revise its economic projections when it meets on Wednesday, raising its estimate for 2023 growth to 2.1% from 1%, and lowering its forecasts for unemployment and inflation. The Fed’s “dot plot”, which shows the interest rate expectations of individual policymakers, would likely show a narrow majority still favouring one more rate hike this year, but only to preserve flexibility for now, the report said.

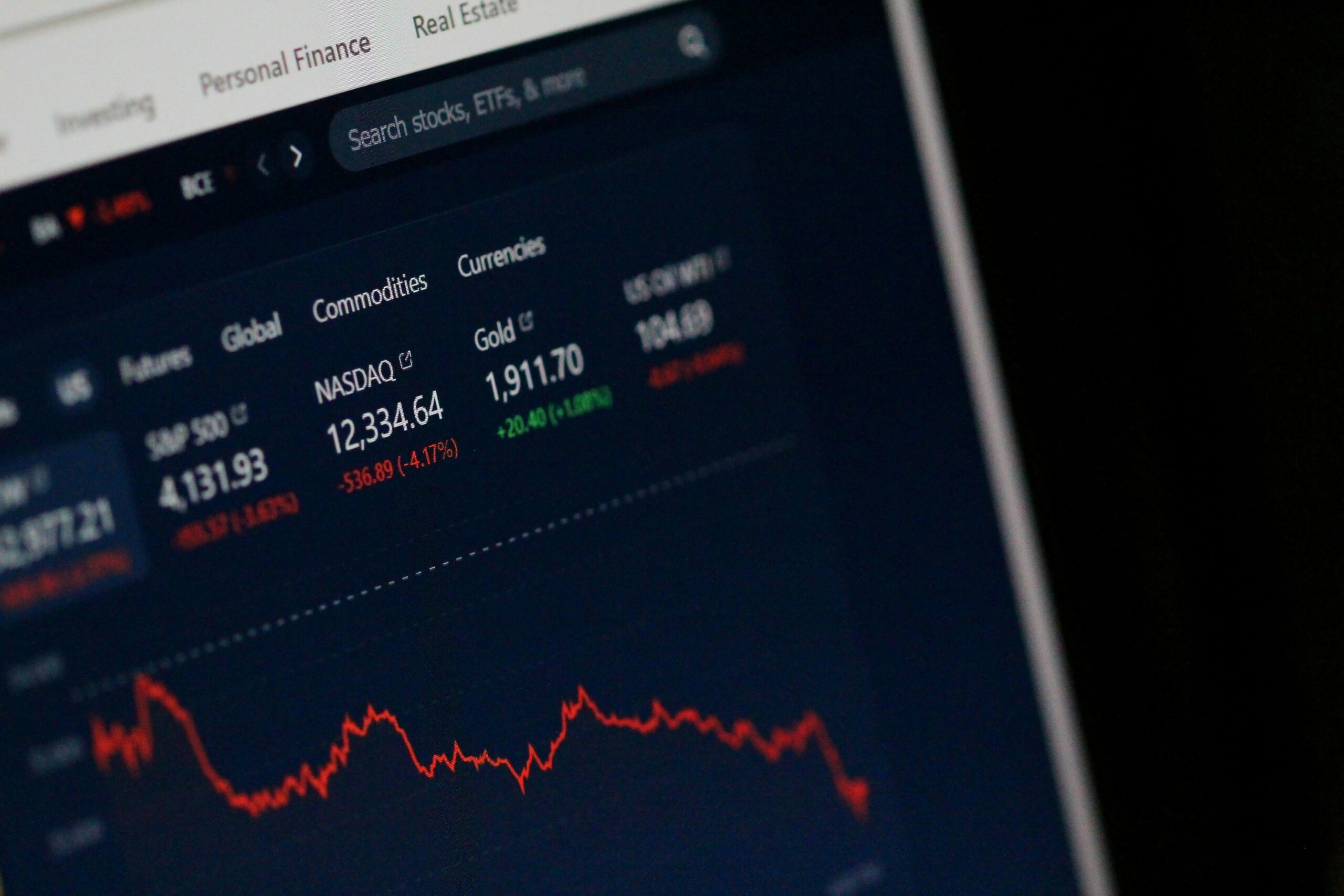

The Fed has raised its benchmark interest rate three times this year, most recently in June, bringing it to a range of 5.25% to 5.50%. The central bank has signalled that it intends to gradually normalize monetary policy after years of keeping rates near zero and buying trillions of dollars of bonds to stimulate the economy after the 2008 financial crisis.

However, some market participants and analysts have questioned whether the Fed needs to continue raising rates, given the subdued inflation and signs of slowing growth in the U.S. and abroad. Some have also argued that the Fed should pause its rate hikes until there is more clarity on the fiscal outlook and the debt ceiling, which Congress will have to raise or suspend by early December to avoid a default.

Goldman Sachs strategists said they expect the Fed to resume its rate hikes in 2024, but at a gradual pace of two or three per year, depending on the inflation outlook. They also said they expect the Fed to start reducing its balance sheet of bonds and other assets next month, as previously announced, but at a slow and predictable rate that would not disrupt the markets.

The report echoed some of the views expressed by Fed officials in recent speeches and interviews, suggesting that the central bank is in no rush to raise rates again this year. Fed Chair Jerome H. Powell said last month that he was “very pleased” with the state of the economy, but also noted that inflation was running below the Fed’s 2% target and that there were “significant” risks from trade tensions and geopolitics.

Other Fed officials have also expressed caution about raising rates too quickly or too far, citing the uncertainty over fiscal policy, the global economy and the impact of past rate hikes on financial conditions. Some have also pointed out that the Fed has room to be patient, as inflation expectations remain well-anchored and wage growth remains moderate despite a tight labour market.

The Goldman Sachs report contrasted with some other forecasts that expect the Fed to raise rates again in December or even sooner. For instance, a survey of economists by Bloomberg last week showed that 70% of respondents expected a rate hike in December, while 13% expected one in November. The survey also showed that economists expected three more rate hikes in 2024, bringing the Fed’s policy rate to 6.25% by the end of next year.