European stocks closed lower on Thursday, as investors digested the latest rate hikes by the U.S. Federal Reserve and the European Central Bank, as well as a series of interest rate decisions from other central banks in the region.

The pan-European Stoxx 600 index slightly trimmed earlier losses to end the session down 0.45%. It comes after the ECB confirmed a widely expected 25 basis point interest rate hike at 1:15 p.m. London time. The ECB also raised its inflation forecast for this year to 2.6%, up from 2.2% in June, and said it expects inflation to remain elevated in the coming months before moderating next year.

The ECB’s move followed the Fed’s announcement on Wednesday that it would keep its benchmark interest rate unchanged at near zero, but signaled that it could start tapering its $120 billion monthly bond-buying program as soon as November. The Fed also indicated that it expects to raise interest rates three times in 2023, up from two previously, and once in 2024.

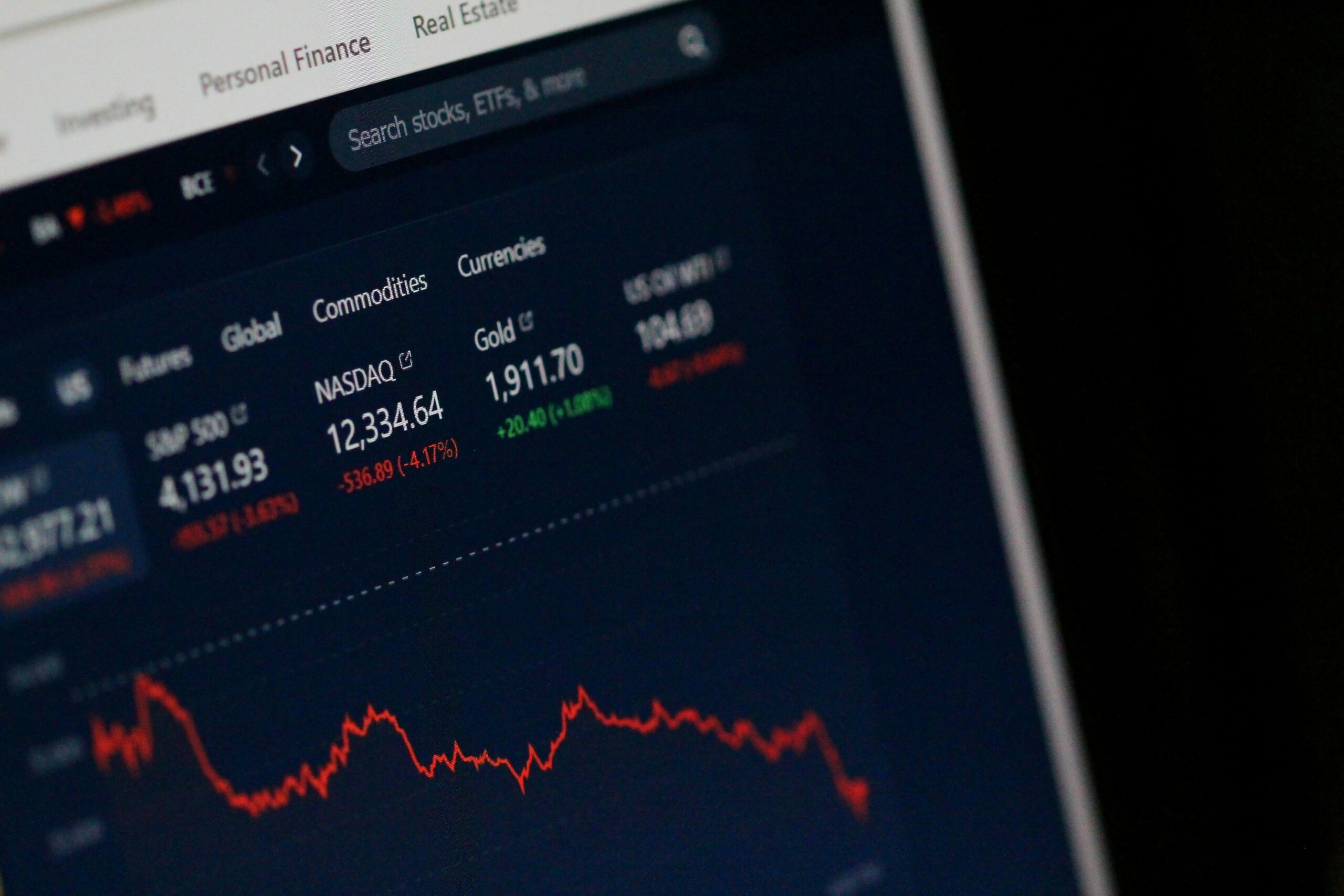

The Fed’s hawkish stance boosted the U.S. dollar and weighed on global markets, as investors worried about the impact of tighter monetary policy on the economic recovery from the pandemic. The dollar index, which measures the greenback against a basket of six major currencies, rose to a nine-month high of 93.56 on Thursday.

Meanwhile, other central banks in Europe also delivered their monetary policy decisions on Thursday, with mixed results. The Bank of England kept its main interest rate at 0.1% and its bond-buying program at £895 billion ($1.23 trillion), but warned that inflation could rise above 4% by the end of the year, double its target. The bank said it would “monitor developments in financial markets carefully” and that “some modest tightening” of policy may be needed over the next three years.

The Swiss National Bank also left its policy rate unchanged at -0.75%, the lowest in the world, and reiterated its willingness to intervene in the foreign exchange market if needed to curb the appreciation of the Swiss franc. The bank said it expects inflation to average 0.4% this year, up from 0.2% in June, and to rise to 0.6% in 2022 and 0.7% in 2023.

The Norges Bank, however, became the first major central bank in Europe to raise interest rates since the pandemic, hiking its key policy rate by 25 basis points to 0.25%. The bank said it expects to raise rates further in December and March, as Norway’s economy recovers faster than expected from the crisis. The bank also lifted its inflation forecast for this year to 3%, up from 2.5% in June, and said it expects inflation to slow to 1.7% in 2022 and 1.6% in 2023.

The Swedish Riksbank kept its repo rate unchanged at zero, but said it expects to start raising rates in the second half of 2022, sooner than previously anticipated. The bank also revised up its inflation forecast for this year to 1.8%, up from 1.4% in July, and said it expects inflation to average 1.7% in both 2022 and 2023.

The Turkish central bank surprised markets by cutting its one-week repo rate by 100 basis points to 18%, despite soaring inflation and a weakening currency. The bank said it expects inflation to peak in October and then decline gradually, thanks to tight fiscal policy and structural reforms. The bank also lowered its inflation forecast for this year to 16%, down from 16.2% in July, but raised its forecast for next year to 14.1%, up from 12.2%.

The diverging monetary policy paths of different central banks reflect the varying economic conditions and challenges faced by each country amid the pandemic. While some countries are grappling with high inflation and strong growth, others are still struggling with low inflation and weak growth.