China’s currency, the yuan, has come under pressure as capital is leaving the country at the fastest rate in over seven years, according to data from the Institute of International Finance (IIF) . The IIF reported that China saw “unprecedented” portfolio outflows from its stocks and bonds in March, even as other emerging markets held up. The timing of the outflows coincided with the escalation of the Russia-Ukraine conflict, which raised geopolitical risks and triggered a global sell-off in fixed income markets.

The IIF estimated that foreign investors reduced their holdings of Chinese government bonds by a record $18.4 billion in February, followed by another $8.7 billion in March. The bond market exodus was partly driven by redemptions among global investors, who faced higher borrowing costs and margin calls amid rising yields. Some analysts also speculated that Russia may have sold some of its Chinese assets to raise funds, as it faced sanctions and a freeze of its foreign reserves held in euros and dollars.

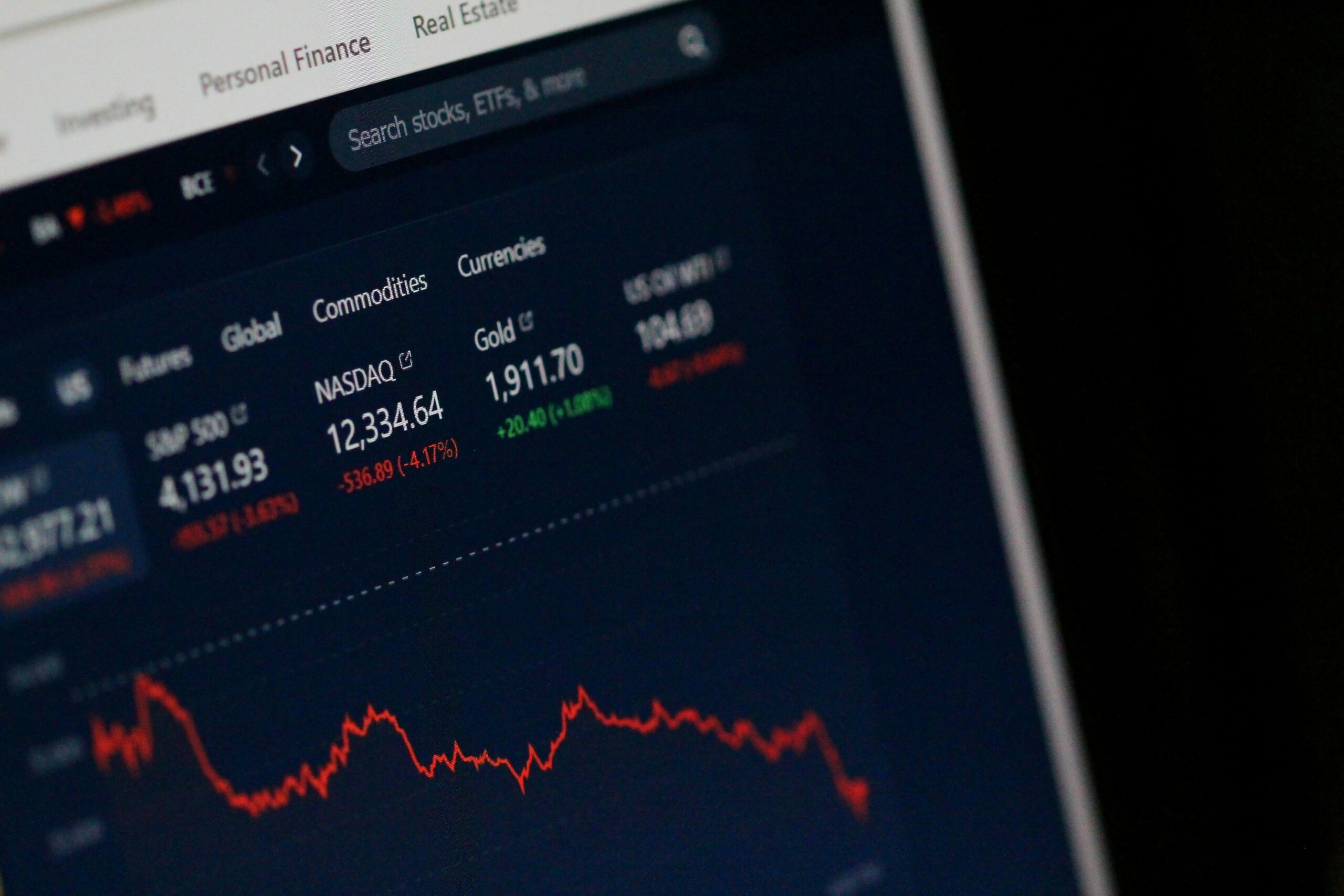

The Chinese stock market also suffered a sharp correction in early March, as overseas investors retreated, partly on concern that the U.S. and European Union sanctions on Russia may somehow spill over to China. The Shanghai Composite Index plunged 7.4% in the first week of March, wiping out $720 billion of market value. Foreign investors sold a net $9.7 billion worth of Chinese stocks via the Hong Kong trading links in March, the most since the links were launched in 2014.

The capital outflows have put downward pressure on the yuan, which weakened 1.3% against the dollar in March, its worst monthly performance since August 2019. The People’s Bank of China (PBOC) has intervened to stabilize the exchange rate, selling a net 118.4 billion yuan ($18.1 billion) of foreign exchange in March, the most since January 2017. The PBOC has also tightened capital controls, requiring banks to hold more foreign currencies in reserve and cracking down on illegal cross-border transactions.

The IIF said that the scale and intensity of the outflows from China were “very unusual”, especially since they contrasted with the inflows to other emerging markets. It suggested that foreign investors may be looking at China in a new light, given its rising geopolitical tensions and its diverging monetary policy from other major economies. China has been tightening its credit conditions to rein in debt and curb asset bubbles, while the U.S. and Europe have maintained ultra-loose policies to support growth and inflation.

However, some analysts said that it was too early to conclude that China was losing its appeal as an investment destination, and that the outflows may be temporary or cyclical . They pointed out that China still offered higher returns and lower risks than many other markets, thanks to its strong economic recovery and effective pandemic control. They also noted that China had made progress in opening up its capital markets and improving its regulatory transparency and governance standards.