South Korean stocks soared on Monday after the government announced a full ban on short selling for about eight months, a move that aimed to curb illegal use of the trading strategy and protect retail investors.

The benchmark Kospi index jumped 5.66 percent to close at 2,502.37, while the small-cap Kosdaq index surged 7.34 percent to end at 839.45. The gains were the biggest since March 2020, when the markets rebounded from the initial shock of the Covid-19 pandemic.

The Financial Services Commission, the country’s top financial regulator, said on Sunday that selling borrowed shares would be prohibited for all stocks listed on the main and secondary markets from Monday through the end of June 2024. The ban was previously lifted in May for large-cap stocks on the Kospi 200 index and the Kosdaq 150 index, while it remained in place for some 2,000 other stocks.

The regulator blamed “massive illegal naked short selling by global investment banks” and other illicit practices for disrupting the markets and hurting retail investors, who have become a dominant force in the local stock market amid low interest rates and easy access to online trading platforms.

Short selling is a trading technique that involves borrowing shares and selling them in the hope of buying them back at a lower price and pocketing the difference. Naked short selling is a more aggressive form of the strategy that involves selling shares without borrowing them first, which is illegal in South Korea.

The regulator said it had launched a probe into several global investment banks, including Goldman Sachs, Morgan Stanley and Credit Suisse, for suspected naked short selling and other violations. It also said it would seek to strengthen the monitoring and enforcement system to prevent such practices in the future.

The ban on short selling was welcomed by many retail investors, who have often complained about the impact of the strategy on the market and staged protests against it. Some lawmakers from the ruling Democratic Party also urged the government to extend the ban ahead of the general elections in April, when the party faces a tough challenge from the opposition.

However, some analysts and institutional investors warned that the ban could hurt the market’s transparency and efficiency, as well as its attractiveness to foreign investors. They also said that short selling could play a positive role in correcting overvalued stocks and providing liquidity.

South Korea is not the only country that has imposed restrictions on short selling amid market volatility. Several countries, including France, Italy and Spain, also banned or limited the practice during the pandemic. However, most of them have since lifted the measures, citing improved market conditions and the need to align with international standards.

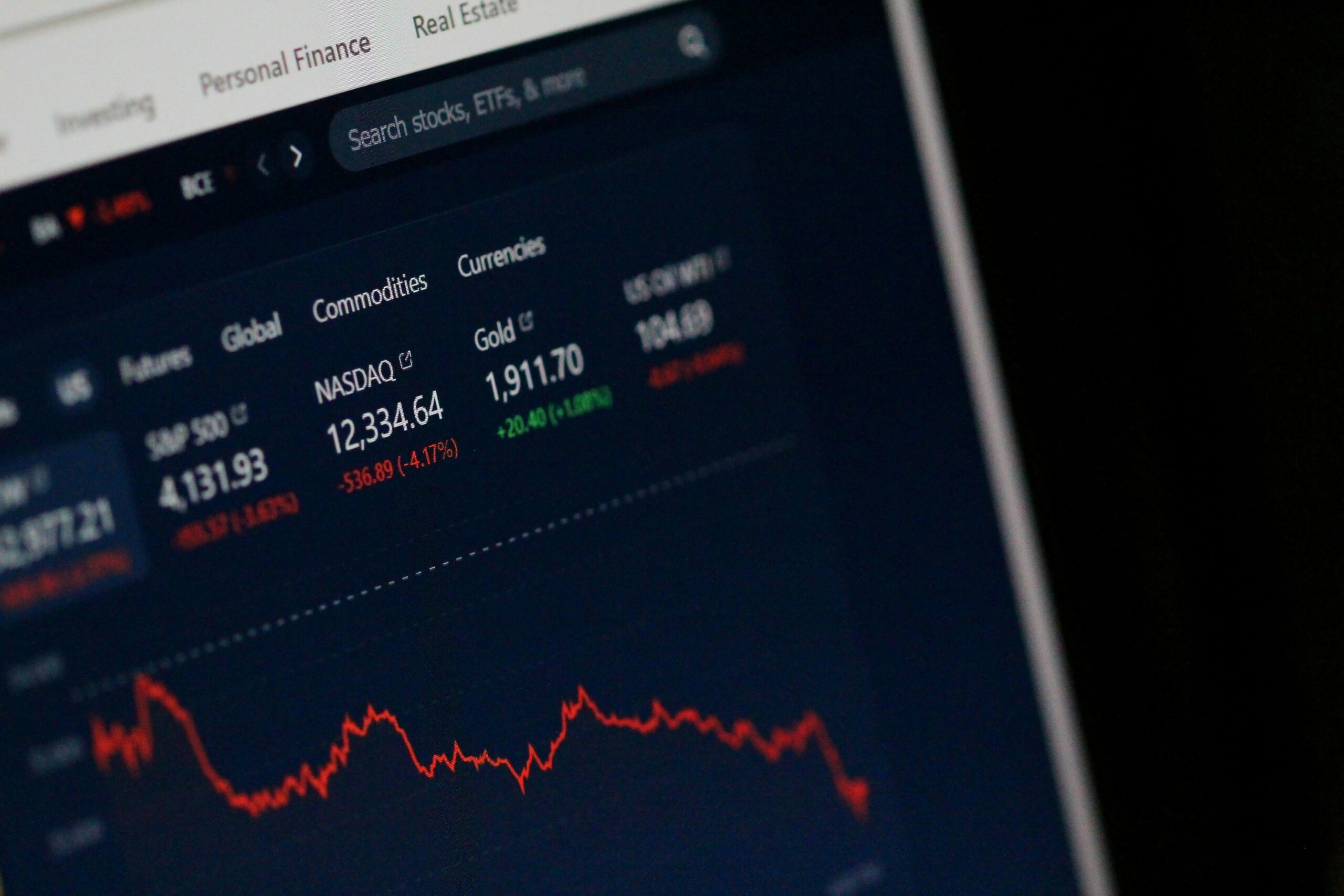

The ban on short selling came as South Korea’s stock market has been on a roller-coaster ride this year, driven by the performance of electric-vehicle battery makers, chip manufacturers and other technology-related stocks. The Kospi index reached a record high of 3,266.37 in July, but then fell into a correction territory in October, losing more than 10 percent from its peak.

The market’s recovery on Monday was led by LG Energy Solution, the country’s largest battery maker, which soared 29.9 percent. The company, which supplies batteries to Tesla and other global automakers, is preparing for an initial public offering that could be one of the biggest in the country’s history.

Other battery-related stocks also rallied, including Posco Future M, a subsidiary of the steel giant Posco that produces materials for batteries, which jumped 29.8 percent. SK Innovation, another major battery maker, rose 14.9 percent.

The ban on short selling also boosted the shares of biotechnology firms, which have been among the most shorted stocks in the market. Samsung Biologics, a contract drug manufacturer, gained 9.9 percent, while Celltrion, a biosimilar maker, advanced 8.9 percent.

The market’s optimism was also supported by the easing of geopolitical tensions on the Korean Peninsula, after South Korea and the United States agreed to end their annual joint military exercises last week. The move was seen as a gesture of goodwill toward North Korea, which has long denounced the drills as a rehearsal for invasion.

The South Korean government also announced on Monday that it would resume humanitarian aid to North Korea, which has been suffering from food shortages and economic difficulties amid the pandemic and international sanctions. The aid, which will include fertilizer and medicine, will be the first of its kind since President Moon Jae-in took office in 2017.