Zhongzhi Enterprise Group, one of China’s largest shadow banks, has declared itself “severely insolvent” and warned of the risk of maintaining normal operations, leaving tens of billions of dollars in losses for its investors.

The Beijing-based conglomerate, which has invested heavily in real estate projects and other sectors under President Xi Jinping’s Belt and Road Initiative, said in a letter to its investors on Wednesday that its total liabilities were up to 460 billion yuan, or $65 billion, against assets of 200 billion yuan.

The company blamed its financial crisis on the departure of key executives after the death of its founder, Xie Zhikun, in December 2021, which led to a situation where “internal management ran wild” and asset impairment was serious.

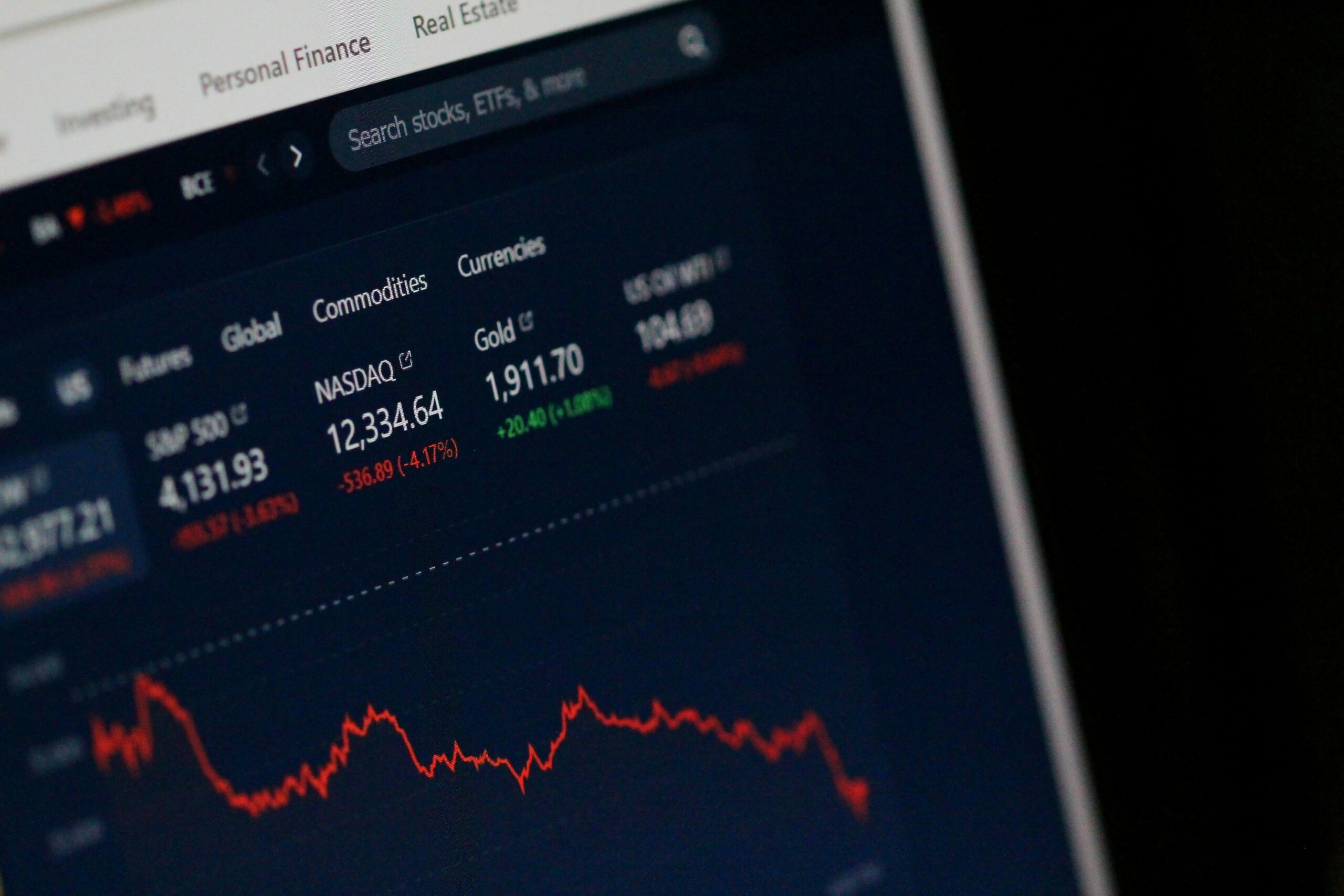

Zhongzhi’s troubles first came to light in August, when its trust subsidiary, Zhongrong International Trust Co, defaulted on several high-yield investment products, sparking concerns about the potential contagion to China’s property sector, which accounts for about a quarter of the country’s economy.

The property sector has been facing a liquidity crunch in recent years, as Beijing imposed strict limits on debt levels for developers, leading to a wave of defaults and restructuring by some of the biggest names in the industry, such as Evergrande and Country Garden.

Zhongzhi’s insolvency adds to the instability in China’s shadow banking sector, which operates outside the regulations that govern traditional banks and involves selling wealth management products to retail investors. The sector is estimated to be worth $2.9 trillion, roughly the size of the French economy.

According to a study by AidData, a research lab at William & Mary University in the US, half of China’s lending to developing countries is not reported in official debt statistics and is often kept off government balance sheets, directed to state-owned companies and banks, joint ventures or private institutions.

The study found that China spent $240 billion bailing out 22 countries that are “almost exclusively” debtors in the Belt and Road project between 2008 and 2021, including Argentina, Pakistan, Kenya and Turkey.

However, China’s rescue lending is far more secretive and less transparent than that of the US or the International Monetary Fund, which regularly make emergency loans to countries in crisis, the study said.

The lack of disclosure and coordination by China’s central bank and state-owned banks and enterprises makes it difficult to measure the impacts and risks of China’s overseas lending, especially in the context of the global pandemic and the slowdown of China’s economic growth.

Zhongzhi’s investors, many of whom are individual savers, are now facing the prospect of losing most or all of their money, as the company said it was unable to repay them in full and asked for their understanding and cooperation.

On Thursday, dozens of retail investors filed formal complaints with the authorities in Beijing, demanding that the government intervene and protect their rights, according to the Financial Times.

The Beijing Public Security Bureau said on Friday that it was investigating suspected crimes of Zhongzhi and its affiliates, and urged investors to report any illegal activities to the police.

The Chinese government has not commented publicly on Zhongzhi’s situation, but has stepped up efforts to solve the property crisis, calling on formal banks to increase their support for 50 large developers and instructing them to plug a shortfall worth $446 billion in the sector.