The International Monetary Fund warned on Tuesday that the world economy was entering a “perilous phase” of low growth and high inflation, and that there was a one-in-four chance of a global recession this year.

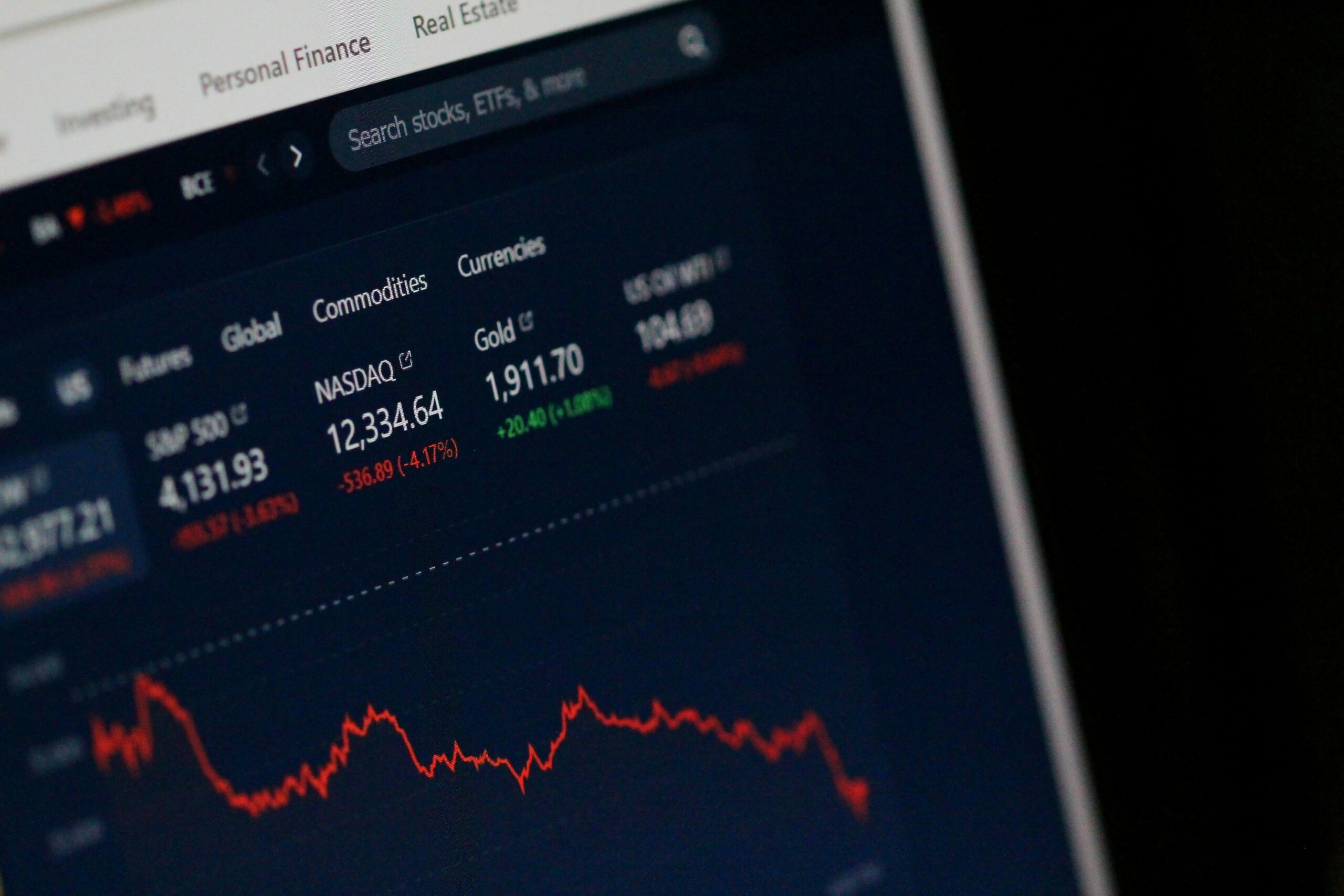

The fund cut its forecast for global growth by 0.1 percentage points for 2023 and 2024, to 2.8% and 3% respectively, citing tighter financial conditions, rising energy and food prices, and the lingering effects of the COVID-19 pandemic. It also said that its medium-term projection for economic output was now at the lowest level since it began publishing these forecasts in 1990.

The IMF’s chief economist, Pierre-Olivier Gourinchas, said that inflation was much more persistent than expected, and that it posed a serious challenge for policymakers who had to balance supporting the recovery and containing price pressures.

“Inflation is much stickier than anticipated even a few months ago,” Mr. Gourinchas said at a news conference. “While global inflation has declined, that reflects mostly the sharp reversal in energy and food prices. But core inflation, excluding the volatile energy and food components, has not yet peaked in many countries.”

Mr. Gourinchas said that central banks should be prepared to raise interest rates if inflation expectations became unanchored, but that they should also avoid overreacting to temporary shocks. He also urged governments to maintain fiscal support for vulnerable households and businesses, but to start planning for a gradual withdrawal of stimulus as the recovery strengthens.

The IMF’s outlook was clouded by several downside risks, including the possibility of new variants of the coronavirus, geopolitical tensions such as Russia’s invasion of Ukraine, and financial instability triggered by higher interest rates.

The fund said that there was now a 25% probability that global growth would fall below 2% this year, which would be equivalent to a global recession. It also said that there was a 10% chance that growth would drop below 1%, which would be comparable to the aftermath of the 2008 financial crisis.

The IMF’s projections showed a wide divergence among regions and countries, reflecting their different exposure to the pandemic and their policy responses.

The United States was expected to grow by 4% this year and 2.9% next year, slightly lower than the fund’s previous forecasts. The IMF praised the Biden administration’s fiscal stimulus and vaccination efforts, but warned that supply bottlenecks, labor shortages and rising inflation could weigh on the recovery.

China was projected to grow by 5.6% this year and 5.2% next year, also lower than previously expected. The IMF said that China’s economy was facing headwinds from its zero-COVID strategy, which has led to strict lockdowns and border closures, as well as from its efforts to rein in debt and financial risks.

The euro area was expected to grow by 2.7% this year and 2.4% next year, slightly higher than before. The IMF said that the euro area had benefited from an acceleration of vaccinations and a relaxation of social distancing measures, but that it still faced challenges from high public debt, low productivity and structural rigidities.

The United Kingdom was forecast to shrink by 0.3% this year, making it the worst performer among the G7 economies, before rebounding to 1% growth next year. The IMF said that the UK’s economy had been hit by Brexit-related trade disruptions, supply chain problems and higher energy costs.

Emerging markets and developing economies were expected to grow by 3.9% this year and 4.9% next year, lower than previously projected. The IMF said that these countries faced multiple challenges from the pandemic, such as limited access to vaccines, weak health systems and low fiscal space.

The fund called for more international cooperation to address these challenges, such as accelerating vaccine donations and distribution, providing debt relief and financing for low-income countries, and strengthening multilateral trade and climate agreements.

“The world is at a critical juncture,” Mr. Gourinchas said. “We need to act now to ensure a durable recovery for all.”