The past month has witnessed a series of bank collapses that have shaken the global financial system and raised fears of another crisis. Three major US banks – Silicon Valley Bank, Signature Bank and First Republic Bank – have failed in quick succession, triggering regulatory interventions and bailouts. Meanwhile, one of the world’s largest banks, Credit Suisse, narrowly avoided collapse after being taken over by its Swiss rival UBS.

What caused these bank failures and what do they mean for the stability of the banking sector and the economy? This article will examine the main factors behind the recent turmoil and the implications for the future.

Silicon Valley Bank: A Tech Bubble Burst

Silicon Valley Bank (SVB) was founded in 1983 as a niche lender to the technology industry. Over the years, it grew to become one of the largest banks in California and a major player in the global tech scene, providing loans, deposits, venture capital and other services to thousands of startups and established firms.

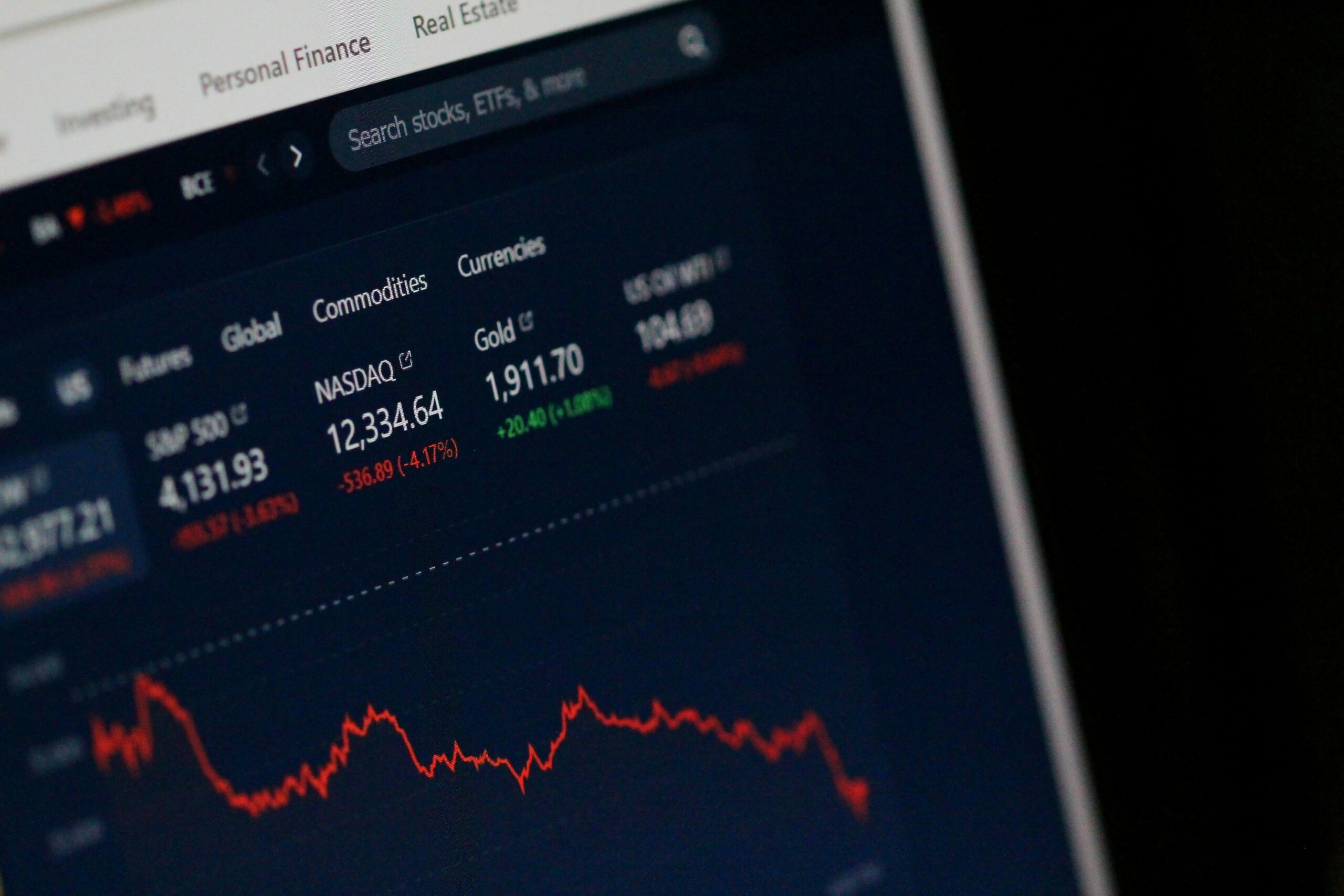

However, SVB’s fortunes turned sour in early 2023, when a sharp correction in the stock market triggered a wave of panic among its customers. Many tech companies saw their valuations plummet and their cash flows dry up, making it harder for them to repay their loans or access new funding. At the same time, many depositors rushed to withdraw their money from SVB, fearing that the bank might go under.

SVB faced a classic bank run, where it could not meet its obligations to its creditors and depositors. Despite receiving a $50 billion emergency loan from the Federal Reserve, SVB could not stem the tide of withdrawals and defaults. On March 10, 2023, the Federal Deposit Insurance Corporation (FDIC) seized SVB and sold its assets and liabilities to JPMorgan Chase, one of the largest US banks.

The collapse of SVB was the biggest bank failure in US history since Washington Mutual in 2008. It also exposed the fragility of the tech sector, which had been enjoying a boom for years but was vulnerable to sudden shifts in market sentiment and liquidity.

Signature Bank: A Crypto Crash

Signature Bank was another regional US bank that specialized in serving niche markets. Founded in 2001, it focused on providing banking services to high-net-worth individuals, businesses and institutions. One of its main areas of expertise was cryptocurrencies, which it embraced as a way to attract customers and generate revenue.

Signature Bank offered a range of crypto-related products and services, such as custody, trading, lending and payments. It also invested heavily in crypto assets itself, holding a large portfolio of bitcoin, ethereum and other digital currencies.

However, Signature Bank’s crypto strategy backfired in March 2023, when a series of events triggered a massive sell-off in the crypto market. First, China announced a crackdown on crypto mining and trading activities, citing environmental and financial risks. Then, Tesla CEO Elon Musk tweeted that he had sold all his bitcoin holdings due to concerns about its energy consumption. Finally, a major hack on a crypto exchange resulted in the theft of millions of dollars worth of digital coins.

These events caused a panic among crypto investors, who dumped their holdings en masse. The price of bitcoin plunged from over $60,000 to below $20,000 in a matter of days. Other cryptocurrencies followed suit. Signature Bank’s crypto portfolio lost billions of dollars in value, wiping out its capital and liquidity.

On March 17, 2023, Signature Bank became the second US bank to fail in a week. The FDIC took over the bank and sold its assets and liabilities to Wells Fargo, another large US bank.

The failure of Signature Bank was the first major casualty of the crypto crash. It also raised questions about the viability and regulation of cryptocurrencies as a form of money and investment.

First Republic Bank: A Liquidity Squeeze

First Republic Bank was founded in 1985 as a private bank catering to wealthy clients. It offered personalized banking services such as private wealth management, trust and estate planning, business banking and lending. It had a reputation for high-quality customer service and conservative risk management.

However, First Republic Bank faced a liquidity squeeze in April 2023, when it became the target of speculation and rumors. Some analysts suggested that First Republic Bank was exposed to risky loans made to real estate developers and leveraged buyout firms. Others claimed that First Republic Bank had lost some of its key clients to competitors or online platforms.

These rumors sparked a loss of confidence in First Republic Bank, which led to a surge in withdrawals and a decline in deposits. First Republic Bank also faced higher funding costs as interest rates rose and investors demanded higher returns for lending to the bank.

First Republic Bank tried to reassure the market by announcing a $10 billion capital injection from a consortium of large banks, including Bank of America, Citigroup and Goldman Sachs. However, this did not stop the bleeding, as customers and creditors continued to flee the bank.

On April 30, 2023, First Republic Bank announced that it had reached an agreement to sell itself to JPMorgan Chase, which had also acquired SVB earlier. The deal was valued at $30 billion and was backed by the US Treasury and the Federal Reserve, which provided guarantees and loans to facilitate the transaction.

The takeover of First Republic Bank was the third US bank failure in less than two months. It also showed the vulnerability of regional banks to liquidity shocks and market rumors.

Credit Suisse: A Risk Management Failure

Credit Suisse was one of the largest and most prestigious banks in the world, with a history dating back to 1856. Headquartered in Zurich, Switzerland, it had operations in over 50 countries and offered a wide range of financial services, such as wealth management, investment banking, asset management and private banking.

However, Credit Suisse suffered a series of setbacks in recent years that eroded its reputation and profitability. It was involved in several scandals and lawsuits related to money laundering, tax evasion, fraud and corruption. It also made some costly bets on risky assets and clients that went sour.

The most notable examples were its exposure to Archegos Capital Management, a family office that imploded in March 2021 after failing to meet margin calls on its highly leveraged positions; and its involvement in Greensill Capital, a supply chain finance firm that collapsed in March 2021 after losing its insurance coverage and facing allegations of fraud.

These incidents resulted in billions of dollars of losses for Credit Suisse, as well as regulatory investigations and legal actions. They also damaged its credibility and trust among its customers and investors.

Credit Suisse tried to recover from these blows by launching a strategic review, replacing some of its top executives and board members, cutting costs and raising capital. However, these measures were not enough to restore confidence in the bank, which faced mounting pressure from shareholders, regulators and rating agencies.

On April 29, 2023, Credit Suisse announced that it had agreed to merge with UBS, its Swiss rival and the largest bank in Switzerland. The deal was valued at $60 billion and was supported by the Swiss National Bank and the Swiss government, which provided guarantees and loans to facilitate the transaction.

The merger of Credit Suisse and UBS was the biggest deal in the history of Swiss banking. It also marked the end of an era for Credit Suisse, which had failed to manage its risks and adapt to changing market conditions.

A Wake-Up Call

The recent wave of bank failures has exposed the weaknesses and vulnerabilities of the banking sector in a post-pandemic world. It has also raised questions about the adequacy and effectiveness of regulation and supervision of banks.

Some of the main lessons and implications are:

• Banks need to be more prudent and vigilant in their risk management practices. They need to avoid excessive leverage, concentration and complexity in their portfolios. They need to diversify their sources of funding and liquidity. They need to monitor their exposures and stress-test their scenarios regularly.

• Banks need to be more transparent and accountable in their disclosures and reporting. They need to provide accurate and timely information about their financial performance, risk profile and governance structure. They need to comply with regulatory standards and ethical norms. They need to communicate clearly and honestly with their stakeholders.

• Banks need to be more resilient and adaptable in their business models. They need to innovate and invest in new technologies and products that meet the changing needs and preferences of their customers. They need to embrace digital transformation and sustainability as strategic priorities. They need to compete effectively in a globalized and dynamic market.

• Regulators need to be more proactive and coordinated in their oversight of banks. They need to ensure that banks have adequate capital, liquidity and buffers to withstand shocks. They need to enforce rules and sanctions for misconduct and violations. They need to cooperate across jurisdictions and sectors to prevent contagion and systemic risk.

The recent bank failures have been a wake-up call for banks. They have also been an opportunity for banks to learn from their mistakes and improve their practices.