The US economy added 253,000 jobs in April, beating expectations and showing resilience amid a global banking crisis that has rattled financial markets and raised fears of a recession.

The unemployment rate fell to 4.1 percent, the lowest since December 2000, according to the Labor Department. The labor force participation rate, which measures the share of working-age people who are employed or looking for work, rose slightly to 61.7 percent.

The job gains were broad-based, with notable increases in leisure and hospitality, education and health services, and professional and business services. Average hourly earnings rose by 10 cents to $30.17, up 4.2 percent from a year ago.

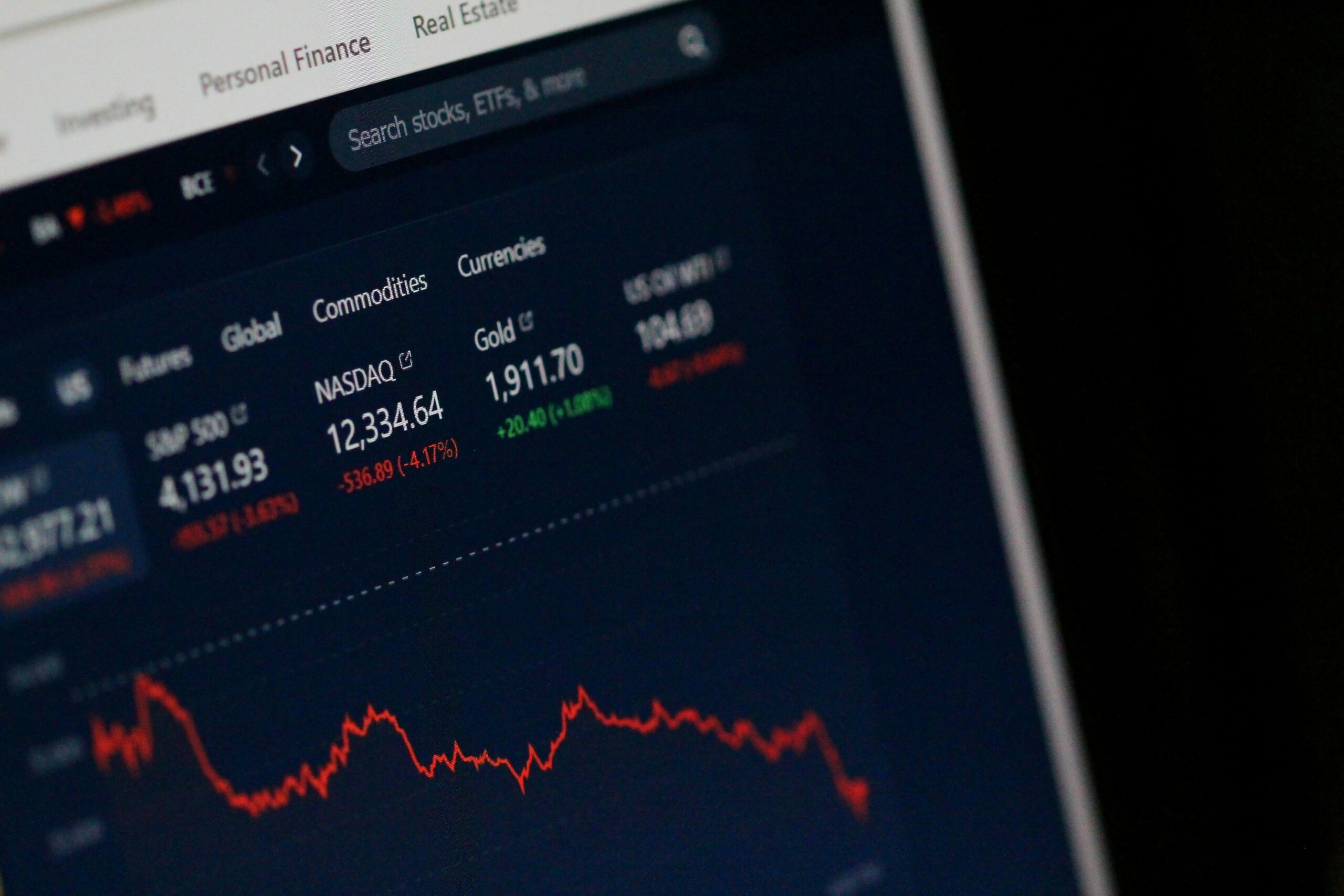

The strong labor market report contrasted with other indicators of economic weakness, such as slowing consumer spending, declining business investment, and falling manufacturing activity. The US economy grew by an annualized rate of 1.6 percent in the first quarter of 2023, down from 2.9 percent in the previous quarter.

The slowdown was partly attributed to the ongoing banking crisis that erupted in March, when a major hedge fund collapsed after making risky bets on derivatives linked to corporate debt. The fund’s failure triggered a chain reaction of losses and defaults among its lenders and counterparties, exposing vulnerabilities in the financial system.

The Federal Reserve and other central banks intervened to provide liquidity and calm markets, but the fallout from the crisis continued to weigh on investor confidence and credit conditions. The Fed raised its benchmark interest rate by a quarter percentage point to 5.5 percent in April, its fourth hike this year, in an effort to contain inflationary pressures.

However, the Fed also signaled that it may pause its tightening cycle in the near future, citing “significant uncertainties” about the outlook for growth and inflation. The Fed’s preferred measure of inflation, the core personal consumption expenditures index, rose by 3.1 percent in March, above its 2 percent target.

Some analysts said the Fed may have to reconsider its stance if the labor market remains strong and inflation does not moderate.

“The Fed is walking a fine line between fighting inflation and supporting growth,” said Diane Swonk, chief economist at Grant Thornton. “The risk is that they may have to raise rates more aggressively if they fall behind the curve.”

Others argued that the Fed should not overreact to temporary factors that are boosting inflation, such as supply chain disruptions, pent-up demand, and base effects from last year’s pandemic-induced slump.

“The underlying trend of inflation is still moderate,” said Gus Faucher, chief economist at PNC Financial Services Group. “The Fed should look through these transitory shocks and focus on the long-term outlook.”

The banking crisis has also raised concerns about the stability of the global financial system and its implications for international cooperation and trade. The US has accused some European countries of lax regulation and oversight of their banks, while some European officials have blamed the US for exporting its financial problems abroad.

The crisis has also strained relations between the US and China, which holds large amounts of US debt and has been accused of currency manipulation and unfair trade practices by the Biden administration. The two countries have been engaged in tense negotiations over a new trade deal that would address these issues.

The banking crisis has also highlighted the need for more financial regulation and reform, both domestically and internationally. Some experts have called for stronger capital requirements, stress tests, and disclosure rules for banks and other financial institutions, as well as more coordination and supervision among regulators.

“The banking crisis has exposed some serious flaws and gaps in our financial system,” said Raghuram Rajan, former governor of the Reserve Bank of India and professor at the University of Chicago Booth School of Business. “We need to learn from this experience and make sure it does not happen again.”